Episodes

Friday Apr 25, 2025

Friday Apr 25, 2025

This week, Jesley, Yu Rong, and Shawn from PropertyLimBrothers tackle the finer points of home buying at the $2.3M, $3M, and $4M price tiers. From layout choices that ‘look’ great online but tell a different story in real life, to surprising trade-offs buyers often overlook, this segment pulls back the curtain on what you’re really paying for.

They explore what makes certain properties more liveable—or more investable—at each price point, and why the sweet spot might not always be where you expect. Hear their perspectives that could turn the tables on how you see the next step in your property journey.

And if you’re wondering if lifestyle or yield should drive your decision… wait ’til you hear their take.

00:00 Introduction01:30 $2.3M budget options06:00 Looking for spacious unit09:02 Options for Boutique Condos09:40 Why some Boutique Condos the price increases?14:36 $3M budget options20:40 $4M budget options (Landed Gems)27:10 Land banking strategy30:15 Luxury options38:34 Luxury unit view39:55 Investing in Core Central Region properties45:39 Closing46:41 Outtakes

Friday Apr 18, 2025

Friday Apr 18, 2025

Jesley, Yu Rong, and Shawn from PropertyLimBrothers answer burning questions from the audience—starting with how young couples should navigate the new BTO model (Standard, Plus, Prime). They break down how different profiles—DINKs, couples with kids, or those planning to upgrade—should choose based on family planning, income potential, and MOP duration.

In the market to sell? They discuss The team shares key considerations beyond just price, touching on personal timelines, future plans, and how to spot the right window of opportunity.

To round off the session, they ask each other—what would they buy with a $1.8M Drawing from PLB’s internal frameworks, each of them shared their approach, from rental-centric plays to lifestyle-driven picks—surfacing often-overlooked choices that blend investment potential with practical liveability. Find out their reasons in this episode and more!

00:00 Introduction01:39 What is the best route for young couples?05:30 Long construction period08:08 Future planning12:30 $6K and $12K budget18:30 Best time to sell24:21 Selecting a RESALE private property32:40 Benefiting from the future MRT lines34:00 $1.8M Budget - Ideal for young families or first timer buyers43:44 Looking at Dual Keys45:50 Details of $1.8M budget options51:40 Next Episode...51:58 Outtakes

Friday Apr 11, 2025

Friday Apr 11, 2025

Thinking of buying your first home but terrified of making the wrong move? You’re not alone. In continuation of our previous NOTG episode, Yu Rong, Alexa, and Lyndon from PropertyLimBrothers dive into Ryan’s case study—a 28-year-old earning $12K a month, who’s on the verge of buying his first property—but struggling with uncertainty.

They explore the modern-day fears of young buyers: market volatility, loan limits, and whether to start with a 2-bedder or stretch for a 3-bedder. Yu Rong reflects on what he wishes he knew earlier, while the team shares crucial tips on saving, splitting your property portfolio, index funds, and insurance hacks just for men.This is the episode every 25 to 35-year-old should hear before making that big decision. Don’t stay passive—your future depends on it. Tune in now!

00:00 Introduction01:02 Ryan’s income growth and property plans02:16 Regrets about past property investment opportunities05:46 Importance of financial knowledge and planning07:39 Current property options for young professionals08:49 Case study: A 26-year-old saving aggressively10:54 Investing in property vs. stock market12:09 Steps for young earners to save and invest15:19 The role of parents in property investment16:47 Saving strategies based on different income levels19:05 Budgeting for living expenses and lifestyle choices22:49 Insurance planning and SAF coverage25:19 Back to Ryan’s property investment strategy27:30 Renting vs buying for young investors28:53 Key financial takeaways from the discussion30:06 Closing remarks and recap32:26 Outtakes

Friday Apr 04, 2025

Friday Apr 04, 2025

In this episode of NOTG, Yu Rong, Alexa, and Lyndon from PropertyLimBrothers break down the realities of property investment for those in their mid-30s to mid-40s. They discuss why managing two properties that align with each spouse’s income can be more strategic than buying a single property based on combined income.

Beyond the numbers, they take a reality check, considering factors such as children, ageing parents, and future expenses, which become increasingly important at this stage of life. Lyndon also shares his personal experience from when he and his wife were in the MOP stage and why he believes in owning two properties—including his preference for four-bedders.

How about you, is it wiser to invest in one property or split your investment into two?

00:00 Introduction00:40 4 Seasons01:09 Ian and Grace’s financial situation02:15 Two-property investment strategy explained03:21 Need for a 4-bedroom home and financial planning05:02 Comparing monthly installments for different property strategies07:02 Managing risk in property investment08:29 Capital appreciation and property value considerations10:36 Choosing between property types for investment12:02 Risk management and financial stability concerns14:13 Investing in two properties despite job instability16:10 Emotional vs. financial decisions in home buying18:26 Extreme financial strategies for early retirement20:22 Personal experiences and financial decision-making23:46 Lifestyle trade-offs when choosing a home26:20 Balancing present lifestyle vs. future financial security28:32 Location trade-offs and financial planning30:31 Maximising property investments32:12 Advising clients on realistic property budgets33:53 Next episode34:30 Outtakes

Friday Mar 28, 2025

Friday Mar 28, 2025

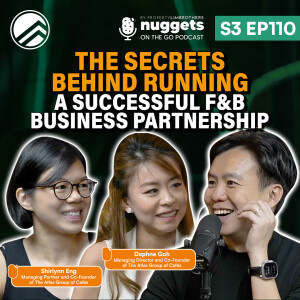

At just 22, Daphne Goh dove into the café world with a marketing degree, a $200K startup fund, and a passion for coffee—launching her first café, Assembly. That’s where she met Shirlynn Eng, a linguistics graduate who, despite receiving a full-time offer as editor, continued working part-time in the kitchen for a year. When Daphne was ready to open her second café, Atlas, she knew exactly who to call—and invited Shirlynn to join her as a partner.

In this episode of NOTG, Melvin Lim chats with Co-Founders Daphne and Shirlynn. They look back to their unconventional journey—how they grew from The Atlas Group of Cafés from one café to a collection of six uniquely crafted brands. They share what it was like building something from scratch, the tough calls, the self-doubts, and the importance of finding the right people and holding on to trust. They also reveal the behind-the-scenes realities most people don’t see in the F&B world—like managing peers of the same age, and realising that leadership means aligning expectations and standing firm—even with friends.

If you’re thinking of starting your own venture or leading a team, there’s a wealth of wisdom waiting for you in this episode!

00:00 Introduction00:57 Ownership of The Atlas Group of Cafés01:08 How they became partners01:57 Expansion of the first café02:36 After graduation to coffee04:31 Taking risks06:34 Challenges in owning a business in a young age08:13 Investment of the first business09:09 Biggest expense10:40 Advice on starting a café14:25 Applied for a part-time service crew, but straight to the kitchen18:11 Transition from a part-timer to a partner20:07 Opening shops in different districts23:43 Challenges of opening a new shop every year26:46 New factory28:08 Seeing all the founders everyday30:00 Easy to burnout with partners / Celebrating 12 years anniversary35:34 Number of crew members36:00 Biggest challenge to managing a team41:57 Growing leaders44:55 Hiring external managers48:57 Biggest cost of running a café51:45 Precious customers52:25 Future plans of Atlas54:38 Rising rental rates55:48 People not believing in you / Curse Unit57:58 Starting all over again01:00:25 What professional skill currently working on?01:02:29 What is holding you back for being your best self?01:03:28 Outtakes

Friday Mar 21, 2025

Friday Mar 21, 2025

Many high-income singles in their 30s are rushing to buy condos for status and wealth preservation—but is it the right move, or just a costly mistake? In this follow-up episode of NOTG, George Peng, Phyllis Goh, and Yong Zhun from PropertyLimBrothers dive into the key considerations for self-employed professionals looking to enter the property market.

They discuss if new launches often are the better investment engine, talk about how to assess financial sustainability when taking on a mortgage, and share the pitfalls of herd mentality in property buying. The conversation also covers whether ‘rentvesting’ can accelerate wealth-building, why the speed of exit is crucial, and what ABSD projections mean for investors. Beyond individual strategies, they also provide insights into HDB and non-landed property price trends in relation to GDP, as well as the Government Land Sales (GLS) programme and its influence on future housing supply.

For more expert perspectives on investment strategies and market trends, this episode equips self-employed professionals with the knowledge to make informed property decisions.

00:00 - Intro00:39 - PERSONA B MAVERICK03:43 - Phyllis’ thoughts about Maverick04:12 - Phyllis’ real life client like Maverick07:06 - George’s advice that are looking for investment13:21 - Yong Zhun’s thoughts about Maverick13:55 - Have you heard of F.I.R.E acronym?14:19 - Retreat and rest18:22 - Phyllis’ consulting something with Melvin23:48 - George’s thoughts about what Phyllis’ consult on Melvin24:25 - Assuming Maverick is working on a bank25:19 - George tells a story about a certain client26:58 - George advice about first timer buyers27:51 - George second client encounter28:10 - Speed of exit28:31 - Going back to Maverick30:40 - One of strategy Maverick can adopt33:13 - Straits Times article34:18 - Yong Zhun’s thoughts about the article35:00 - Cooling measures34:43 - A few things to look at38:13 - Private residential price index41:10 - Interesting Q141:18 - Supply and demand list42:32 - HDB & Private Non-Landed Property Price Index43:30 - Closing messages46:29 - Other personas47:32 - Outtakes

Friday Mar 14, 2025

Friday Mar 14, 2025

Wayne and Joanne, both 27 years old and earning $4,000 each, are ready to take the next big step—buying their first home. But with skyrocketing property prices and so many options, they’re unsure where to start. Should they go for a BTO, resale HDB, or a resale condo? What if they make the wrong decision?

In this episode of NOTG, George Peng, Phyllis Goh, and Yong Zhun from PropertyLimBrothers break down exactly what young couples need to consider before making their first property purchase. Understand how to prioritise capital gain and long-term planning, avoid common mistakes, and assess the pros and cons of different housing options. Learn why Minimum Occupation Period (MOP) and Seller’s Stamp Duty (SSD) matter, and find out how an investment portfolio comprising stocks and crypto could influence property selection.

If you fit the persona, are struggling with uncertainty and want clear, practical advice on buying your first home, this is the episode you don’t want to miss!

00:00 - Intro00:48 - Introducing host1:06 - Phyllis Goh02:27 - Persona A Wayne and Joanne03:53 - George’s first pay05:14 - Phyllis’ studies05:58 - Big gap and prices06:17 - Personal Disposable Income/Savings chart06:57 - George’s thoughts about Wayne and Joanne07:13 - Phyllis’ advice09:18 - Yong Zhun’s thoughts about Wayne and Joanne10:06 - Three choices on Wayne and Joanne’s situation12:02 - Main 2 choices suggested by Yong Zhun (Resale HDB)13:29 - Main 2 choices suggested by Yong Zhun (Resale Condo)17:42 - What is a good and bad property purchase?18:41 - Pros and Cons of resale HDB and Condo22:41 - Timeline of Wayne and Joanne24:13 - When to take BTO Route25:12 - When divorce happen25:43 - 99 years ownership on condo during divorce31:41 - CCR, RCR, OCR35:15 - George advice to Wayne and Joanne situation35:22 - If George is in Wayne and Joanne’s situation36:24 - George opinion on insurance37:24 - Kids needs38:22 - George go BTO if he is on similar situation39:07 - What would Yong Zhun do?40:09 - When George take the BTO he would do it intentionally. Why?40:26 - George remembering something about BTO41:47 - Continuing on when George take the BTO route why would he do it intentionally.43:06 - Parting message for Wayne and Joanne43:56 - 9 years after on Wayne and Joanne situation47:06 - 9 years later breakdown51:53 - Part 2 teaser52:13 - Outtakes

Friday Mar 07, 2025

Friday Mar 07, 2025

Every experience is a dot waiting to be connected. The more you explore—through the people you meet, the lessons you learn, and the risks you take—the clearer the bigger picture becomes. For Johnathan Chua, CEO and co-founder of GRVTY Media, these dots have shaped his entrepreneurial journey in unexpected ways. From growing up in a family of entrepreneurs to resigning just two weeks after a pay rise, every decision led him toward building one of the region’s most recognised media companies.

In this episode of NOTG, hosted by Melvin Lim, Johnathan reflects on the pivotal moments that shaped his career—the realisations, the challenges, and a tough but invaluable lesson learned from a $4,000 business pitch failure. But beyond business, he delves into personal growth—the shift from being direct and assertive to becoming a more mindful and rational leader.

He reveals an unconventional business idea inspired by a trip to Australia, reimagining what retirement homes could look like. Plus, his take on hiring friends, why he prioritises value over cost-cutting, and the advice he would give aspiring entrepreneurs. Every experience leads somewhere. Tune in to hear how Johnathan’s journey might help you make sense of the dots in yours.

00:00 Intro01:04 Family business and entrepreneurial background03:01 Discussion about parents running businesses04:15 Studying hospitality and business management05:12 Regrets and educational journey07:04 Getting married and financial considerations07:47 First jobs and early career experiences12:17 Needing a salary raise15:06 Asking for a raise and the emotional reaction from his mom18:38 Considering pharmaceutical sales and commercial diving for money20:38 Joining Vulcan Post and evolving into GRVTY Media24:33 The creation of "Real Talk" and challenges with monetization27:05 Differentiating GRVTY Media from other creative agencies30:51 Overthinking vs underthinking in business decision-making34:04 Managing talents and challenges of talent retention39:03 Lessons on business models and avoiding a race to the bottom42:06 Interest in solving retirement issues and future goals49:50 The "Last Resort"50:10 The emotional toll of being an entrepreneur53:51 Different personality types for different persons55:49 Firing people57:12 Quitting GRVTY Media59:58 Hiring friends and firing friends1:04:20 Finding the source of the problem in the company1:06:30 It's just a job1:07:26 Future plans, who is going to take over GRVTY Media1:09:51 Underdog fears1:11:20 First impression leads to connections1:11:48 Advice to entrepreneur1:13:03 Superpower to help at your work1:20:08 Closing thoughts1:20:20 Outtakes

Friday Feb 28, 2025

Friday Feb 28, 2025

Buying your first property is a significant milestone, but what happens when you decide to do it with a friend? George , Jun Wei, and Yu Rong from PropertyLimBrothers talk about crucial decisions that Ryan, a 28-year-old earning $6,000 per month, must make as he plans to co-own a property. They break down why floor plan efficiency matters for long-term value, how to spot price differences within the same development, and how much Ryan can actually afford to borrow.

More importantly, they tackle the tough but necessary questions: What happens if one party wants to sell? Gets married? Loses their job? Can a legal agreement protect both owners? Plus, they reveal why 900+ sqft three-bedders are becoming hot investments, if Yishun could be the next big thing, and what to expect in the 2025 property market.

If you’re thinking about buying with a friend, be sure to watch this episode firs

00:00 Introduction00:41 Ryan’s Profile: 28 Years Old, $6,000 Income01:05 Young Homebuyers: Is Property Investment Possible?03:09 The Potential of 900+ Sqft 3-Bedroom Units05:14 Best Bus Interval and Capacity near a development07:05 Tips for Symphony Suites Homeowners10:06 Upcoming Transport Changes & Area Transformation13:02 Can Ryan Afford a Property? Loan Calculations15:58 Buying Property with Friends: Key Considerations18:46 Risks & Challenges in Co-Investing22:02 Financial Structuring: Agreements & Exit Strategies27:26 Why Solo Investing Might Be Better30:47 Handling Unexpected Income Growth & Market Timing36:07 Renting vs. Buying: Financial Implications40:26 2025 Market Predictions & Property Trends45:07 The Role of Old Money in Real Estate Investments50:03 Smart Investment Strategies55:01 Closing Words56:17 Outtakes

Friday Feb 21, 2025

Friday Feb 21, 2025

What if the home you choose today could either unlock financial freedom or become your biggest regret? Today on NOTG, George, Jun Wei, and Yu Rong dive into the high-stakes decision faced by personas Peter and Lucy, a couple earning $25,000 each, torn between a landed property or a high-quantum 4- or 5-bedder condo.

With a $4 million to $5 million loan on the table, the wrong move could mean stretching their finances too thin or missing out on future gains. Should they prioritise an own-stay home, an investment strategy, or a mix of both? Which option carries the biggest risks or the highest upside? The discussion digs into the real impact of stress test rates, explores landed home conditions, and breaks down how uneven income between partners can affect ownership structure.

Plus, why installing a lift in a landed home might be one of the smartest investments they can make. For those planning their next big property decision, this episode offers a data-driven perspective on what works, what doesn’t, and how to make the most of every dollar invested. Tune in now!

00:00 Introduction01:31 Today’s Topic: Real Estate Personas03:03 Peter & Lucy: High-Income Home Buyers' Dilemma04:09 Common Fears When Buying Property05:46 Financial Calculations & Loan Considerations08:04 Case Study: A Couple’s Real Estate Investment Strategy10:30 Leasehold Concerns & En Bloc Discussions14:10 Evaluating New Launch vs. Landed Property16:37 Landed Property Rental Yield Considerations19:05 Weighing Risk & Reward in Property Investment23:58 Peter & Lucy’s Property Investment Options30:12 Financial Strategy: Diversifying Real Estate Investments39:00 Understanding Property Classes (Landed, Condo, HDB)45:17 Property Selection Factors & Market Trends54:13 Next Episode...55:08 Outtakes